Fully automated inventory based lending:

More insight, Less Risk, More Efficiency

Are you a credit provider? Are you looking for substantiated information about your (potential) client’s inventory? Request a demo and find out what Finventory can do for you.

Do you represent a company that is looking for inventory financing? Do you want to prove the value of your collateral with more clout? Discover the added value Finventory can offer you as a borrower.

Our solution

Demand for inventory ever increases Supply chains are disrupted and redesigned due to Covid and geopolitical turmoil. E-commerce is on the rise, availability of product is key. Seasonal cycles require companies to plan their working capital over time, by creating buffers. But companies need to fund it!

Finventory offers the toolkit to manage these types of funding!

Finventory is your inventory based lending superhero!

Fully automated

Fully automated

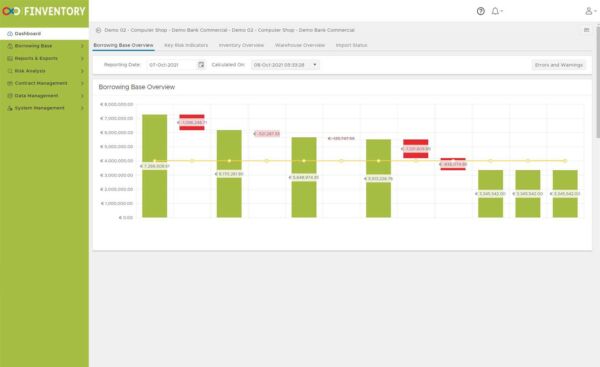

All relevant data are fully automated extracted from borrower’s ERP system or 3rd party WMS system. Borrowing bases are automatically calculated, risk factors and covenants are automatically monitored through configurable Key Risk Indicators, and alerts are automatically raised.

No more manual work, time freed up for more value adding activities on both sides

More insight

More insight

High, daily frequency of data points renders better trend analyses and risk monitoring. Both lender and borrower have access to the platform, using the same data and sharing a single

truth, enabling better dialogue. Anomalies in data are automatically detected and fed back to borrower and lender.

Want to know anything, about any risk factor: Finventory knows

Less risk

Less risk

Earlier detection of a credit deterioration, through configurable Key Risk Indicators. Less risk of fraud, because data are retrieved directly and at a daily frequency from client’s core system and automated plausibility checks are done.

Communicate on risks, instead of data

More effeciency

More effeciency

Workflow support that can be configured to align with your internal processes. Our system is purposely built to integrate the data in any desired form with your core system. No more manual data processing. Just log in to Finventory and start your collateral risk management activities.

No time needed anymore to crunch data, but instead to work with information

Results

- Better risk based financing solutions, aligned to the risk profile of the borrower

- Better insight, leading to a deeper relationship between lender and borrower

- Less losses on the inventory based lending portfolio

- Free up time for more value adding activities instead of numbers crunching

Safety First: protecting your data

Our Information Security Management System is ISO 27001 certified.

This means we continuously look for opportunities to improve our Information Security Management System at operational, technical and strategic level.

Reputable external security consultants help us by providing expertise on secure software development and information security in general.

Future

A company’s inventory is in constant motion. The same goes for the Finventory platform. With the help of algorithms, we can predict liquidation valuations or turnover results ever more accurately. Finventory’s vision of the future is clear: evolve into a dynamic platform where the flow of goods is matched with the flow of money within the supply chain. In that respect, the Finventory platform is also an optimisation tool and an additional service that you as a creditor can offer to the supply chain player within your network.