Financing challenge

As a creditor, you are constantly balancing on a tightrope. On the one hand, you want to build customer loyalty: customers who are able to realise their project thanks to your credit are satisfied customers. Satisfied customers in turn contribute to the growth and reputation of your credit institution. On the other hand, you have to be strict about the collateral offered by the collateral. When your borrower provides those guarantees through an inventory, it becomes even more challenging. Now creditors can count on Finventory at such strategic moments.

The services for the creditor

Data processing

Finventory offers a technological platform that processes data automatically. The platform can interface with various data sources such as ERP and warehouse management systems (WMS). The data can be loaded fully automatically on a daily basis, without manual intervention.

Borrowing base

The Finventory platform calculates the most accurate borrowing base. This occurs on the basis of differentiated advance payments and the exclusion of non-financeable products.

Risk analysis

Finventory provides the tools you need to make a thorough risk analysis. These include the configurable key risk indicators and the monitoring of covenants.

How does Finventory work?

Finventory has only one goal: to create a win-win situation for creditors and borrowers based on well-founded analyses. Finventory also attaches importance to a highly transparent way of working. Both parties always have access to the same identical data.

Finventory works in four phases.

Data extraction

“Data is king”. Inventory data is a first essential step to get started. Finventory uses a structured database to process inventory data from ERP and warehouse management systems. Finventory accepts different types of files and data. The user-friendly platform also has a minimal impact on the borrower’s IT infrastructure.

Information processing

Data is only as valuable as the information it provides. Finventory translates the data into customer- and inventory-specific information. Some examples of risk factors are perishability, seasonality, sales forecasts, sales margins and unpaid products. Such information structures allow you – as a lender or as a borrower – to make valuable and relevant analyses.

Calculation borrowing base

Finventory’s platform calculates the borrowing base. It takes into account the risks and the variable rates, in short, all the parameters arising from the credit agreement. This includes the retention of title and the exclusion of ineligible products.

Analysis & Monitoring

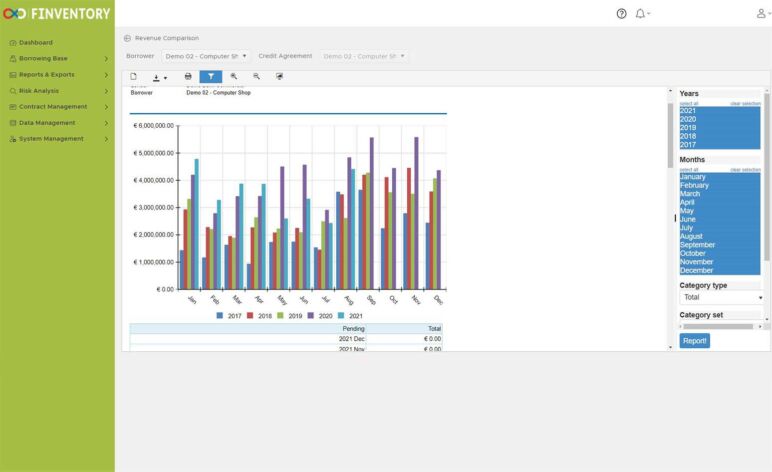

Finventory offers an analysis and monitoring tool for both creditors and borrowers. As a user, you can analyse all specific risk factors, product categories and relevant details, both at one time and over a period of time. As a creditor, you can compare the borrowers in your portfolio. The purpose? Monitoring credit risk and the collateral in a uniform manner.

Who is the platform intended for?

The platform aims to establish a dialogue between creditor and borrower. Both parties will have access to the same information and analysis capabilities. Usually borrowers are introduced to Finventory by the creditor and the creditor pays Finventory. The creditor may pass on part of the costs to the borrower.

How does Finventory collect the necessary information?

Uploading information about companies on the Finventory platform is fully automated. Finventory creates secure links to the borrower’s systems (e.g. an accounting or ERP system or a so-called warehouse management system). This enables Finventory to automatically import the required data into the Finventory platform at the times agreed with the borrower and creditor and to automatically calculate the loan amount for the day in question. Borrower and creditor can also do all kinds of analyses based on the imported data. The borrower retains control of the data at all times. He can check what data has been retrieved from his systems and when, and can also withdraw authorisation to import data from the business systems at any time.

How does the onboarding of a new company work?

The onboarding usually takes place in five steps. Often the borrower is introduced to Finventory by the creditor. The following five steps then ensure that the borrower is connected to our platform:

1.

Finventory organises an intake meeting with the borrower. In this meeting, Finventory gains insight into the borrower’s business processes and the contact persons, while the desired timelines are also determined. Finventory also provides insight into the measures we take to protect the information.

2.

Then the technical connection to the borrower’s systems is established. Finventory has several methods to “talk” to borrowers’ business systems. It depends on the type of system which method is most suitable.

3.

Once the connection has been made, Finventory will arrange the data streams so that the correct information is loaded. We load the raw data and analyse it. We then make the borrower’s data visible on our platform for the borrower.

4.

The borrower checks that the company’s data is correctly displayed. Only if the borrower gives his approval, the creditor can access these data. The borrower retains full control over his own data at all times.

5.

The information is released to the creditor. The creditor, together with Finventory, configures the credit agreement on the platform and the process is complete.

In all these steps, Finventory ensures that the IT impact on the borrower’s systems remains minimal. However, during the onboarding process, an IT expert and a financial expert from the borrower and Finventory will interact.

How does Finventory secure such large amounts of confidential data?

Finventory applies similar security standards that are also imposed on banks:

• Security by design: important architectural changes or changes to the software are submitted in advance to an external IT security expert. In this way, Finventory ensures that the design already meets the safety requirements.

• Code scanning: each new version of the software is scanned beforehand for IT security risks with the help of an external tool. In this way, vulnerabilities in the programming code are already detected during the development process and not only during use.

• Awareness: a company is only safe when its employees are aware of the risks. Our team is trained to understand those risks. For example, we organised a hacker workshop to experience how to break into systems.

• IT security assessment: we let an external party perform a penetration test (hacker test) in which the tester tries to break into our systems. This party gets full access to the programming code.

• Good processes that comply with international standards: Finventory has documented its processes extensively. The processes comply with international standards and are also certified according to international standards (ISO 27001).

What data will be included in the platform?

The data of a borrower that Finventory imports onto the platform depends in part on the borrower’s business process. For example, perishability data will play a role in a food company but not in a metal company. The Finventory platform supports, among others, the following data: numbers and value of products per location, product characteristics, age of the inventory, inventory turnover and perishability. On the platform, the borrower and creditor are given the opportunity to analyse all these data on a specific day (you get a snapshot of the inventory) or over a whole period (you get a film that analyses the development of the inventory over a chosen period). Transparency is very important to Finventory and all parties are given equal access to the information and analyses.

Who is the platform intended for?

The platform aims to establish a dialogue between creditor and borrower. Both parties will have access to the same information and analysis capabilities. Usually borrowers are introduced to Finventory by the creditor and the creditor pays Finventory. The creditor may pass on part of the costs to the borrower.

How does the onboarding of a new company work?

The onboarding usually takes place in five steps. Often the borrower is introduced to Finventory by the creditor. The following five steps then ensure that the borrower is connected to our platform:

1.

Finventory organises an intake meeting with the borrower. In this meeting, Finventory gains insight into the borrower’s business processes and the contact persons, while the desired timelines are also determined. Finventory also provides insight into the measures we take to protect the information.

2.

Then the technical connection to the borrower’s systems is established. Finventory has several methods to “talk” to borrowers’ business systems. It depends on the type of system which method is most suitable.

3.

Once the connection has been made, Finventory will arrange the data streams so that the correct information is loaded. We load the raw data and analyse it. We then make the borrower’s data visible on our platform for the borrower.

4.

The borrower checks that the company’s data is correctly displayed. Only if the borrower gives his approval, the creditor can access these data. The borrower retains full control over his own data at all times.

5.

The information is released to the creditor. The creditor, together with Finventory, configures the credit agreement on the platform and the process is complete.

In all these steps, Finventory ensures that the IT impact on the borrower’s systems remains minimal. However, during the onboarding process, an IT expert and a financial expert from the borrower and Finventory will interact.

How does Finventory collect the necessary information?

Uploading information about companies on the Finventory platform is fully automated. Finventory creates secure links to the borrower’s systems (e.g. an accounting or ERP system or a so-called warehouse management system). This enables Finventory to automatically import the required data into the Finventory platform at the times agreed with the borrower and creditor and to automatically calculate the loan amount for the day in question. Borrower and creditor can also do all kinds of analyses based on the imported data. The borrower retains control of the data at all times. He can check what data has been retrieved from his systems and when, and can also withdraw authorisation to import data from the business systems at any time.

How does Finventory secure such large amounts of confidential data?

Finventory applies similar security standards that are also imposed on banks:

• Security by design: important architectural changes or changes to the software are submitted in advance to an external IT security expert. In this way, Finventory ensures that the design already meets the safety requirements.

• Code scanning: each new version of the software is scanned beforehand for IT security risks with the help of an external tool. In this way, vulnerabilities in the programming code are already detected during the development process and not only during use.

• Awareness: a company is only safe when its employees are aware of the risks. Our team is trained to understand those risks. For example, we organised a hacker workshop to experience how to break into systems.

• IT security assessment: we let an external party perform a penetration test (hacker test) in which the tester tries to break into our systems. This party gets full access to the programming code.

• Good processes that comply with international standards: Finventory has documented its processes extensively. The processes comply with international standards and are also certified according to international standards (ISO 27001).

What data will be included in the platform?

The data of a borrower that Finventory imports onto the platform depends in part on the borrower’s business process. For example, perishability data will play a role in a food company but not in a metal company. The Finventory platform supports, among others, the following data: numbers and value of products per location, product characteristics, age of the inventory, inventory turnover and perishability. On the platform, the borrower and creditor are given the opportunity to analyse all these data on a specific day (you get a snapshot of the inventory) or over a whole period (you get a film that analyses the development of the inventory over a chosen period). Transparency is very important to Finventory and all parties are given equal access to the information and analyses.